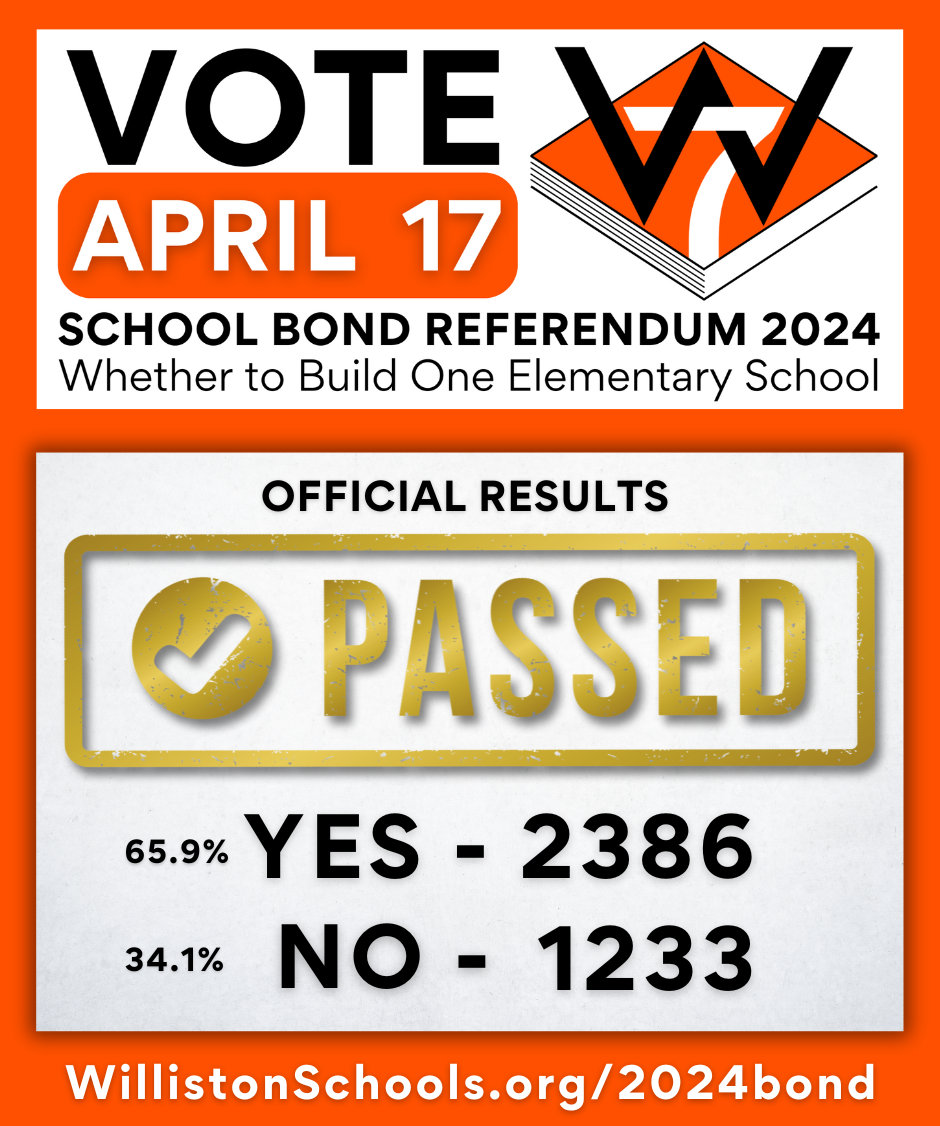

2024 School Bond Referendum PASSED!

Click Here for Bond Project Information & Updates

05/01/2024 PRESS RELEASE

WILLISTON BASIN SCHOOL DISTRICT #7 SCHOOL BOND REFERENDUM PASSED

Williston, N.D. (May 1, 2024) The Williston Basin School District #7 is pleased to announce the successful passage of the school bond referendum, as indicated by the official tally from the election held on April 17th, 2024. With 65.9% "yes" votes, the bond's official approval surpassed the necessary 60% supermajority.

The official vote count is as follows:

· Yes: 2,386

· No: 1,233

· Total Votes: 3,619

The canvassing of the election to verify and finalize the official results took place Tuesday, April 30th at 5:00 PM in the District Office board room.

The $35 million bond aims to provide funding for the construction, equipping and purchase of land for one new elementary school. The chosen site for the new elementary school is in Williston Square. The estimated total project cost is $55 million, with the district contributing $20 million (36%) from District Building Funds.

For a detailed breakdown of results by voting location and absentee votes and for more information about the bond, please visit our bond webpage on the Williston Basin School District #7 website.

Thank you to everyone who participated in the voting process and contributed to this significant milestone for our district.

CLICK HERE for PDF Copy of Press Release

April 17, 2024 Bond Referendum Election

Official Results (After Canvassing)

Location | Yes | No | Total | % Yes | % No | Not Counted |

|---|---|---|---|---|---|---|

ARC | 851 | 694 | 1,545 | 55.1 % | 44.9% | - |

WMSCC | 240 | 128 | 368 | 65.2% | 34.8% | - |

Hagan | 167 | 56 | 223 | 74.9% | 25.1.% | - |

WHS | 143 | 77 | 220 | 65% | 35% | - |

Absentee | 978 | 273 | 1,251 | 78.2% | 21.8% | - |

Canvassed | 7 | 5 | 12 | 58.3% | 41.7% | 19 |

TOTAL | 2,386 | 1,233 | 3,619 | 65.9% | 34.1% | 19 |

Our Mission

Our Mission is to inspire and prepare students for the next level of education, work, and life.

Our Vision

Our Vision is to foster student growth and build trusting partnerships between students, staff, family, and community. An education at WBSD#7 will support our student's intellectual, social, and emotional growth. We will provide students with an innovative curriculum supported by various co-curricular activities. The outcome of our efforts will empower students to make a difference in their community and world.

Our Belief

We believe in providing a safe environment where healthy relationships and student growth are priorities.

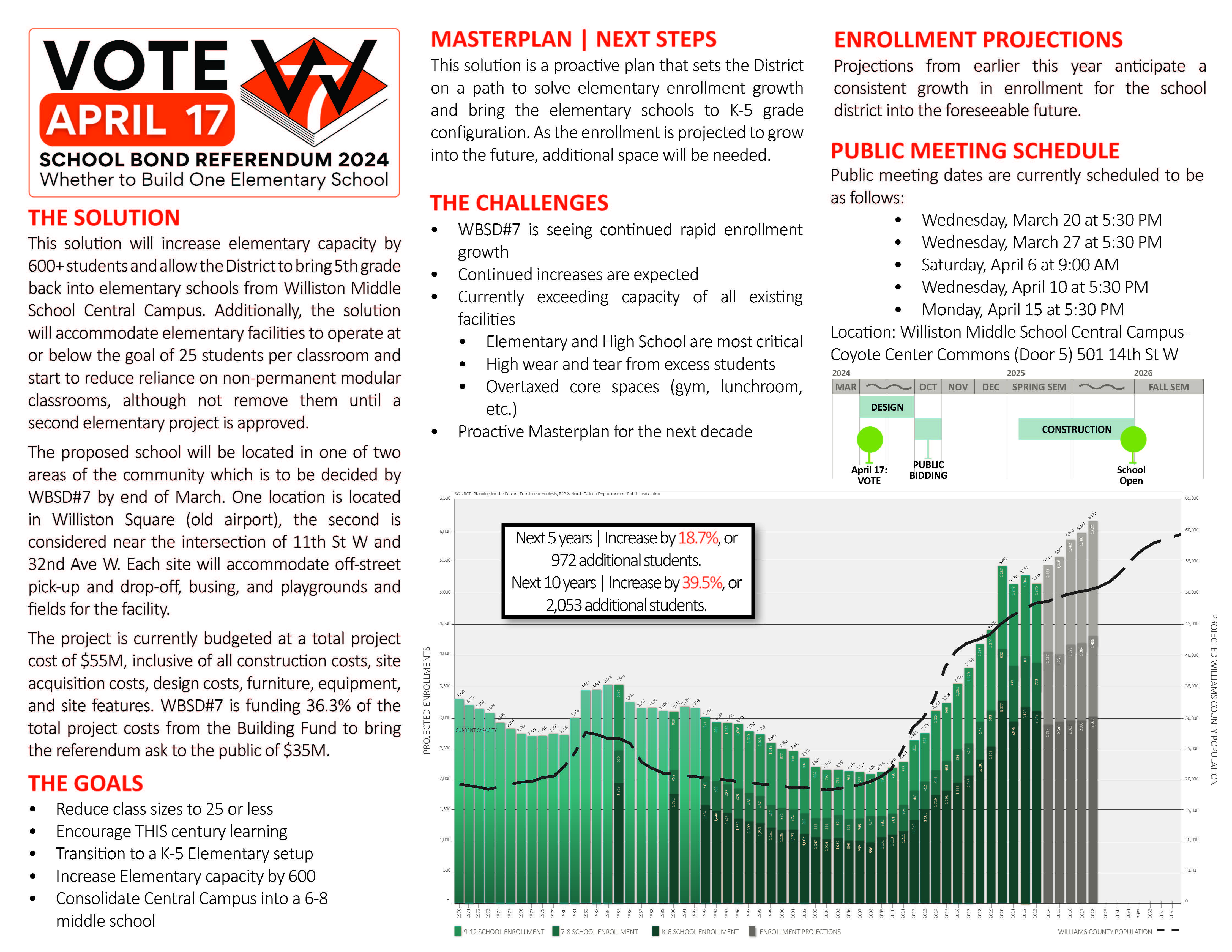

CHALLENGES & PROPOSED SOLUTIONS

CHALLENGES

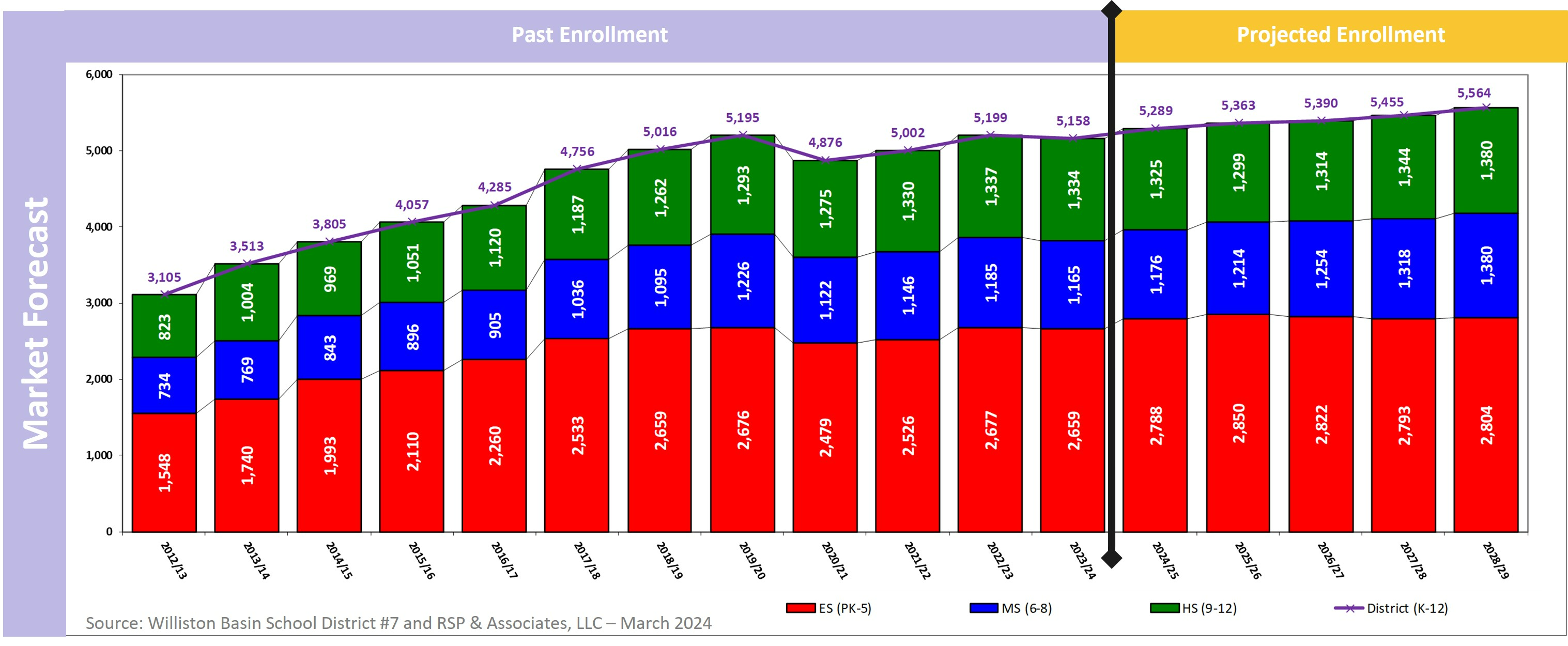

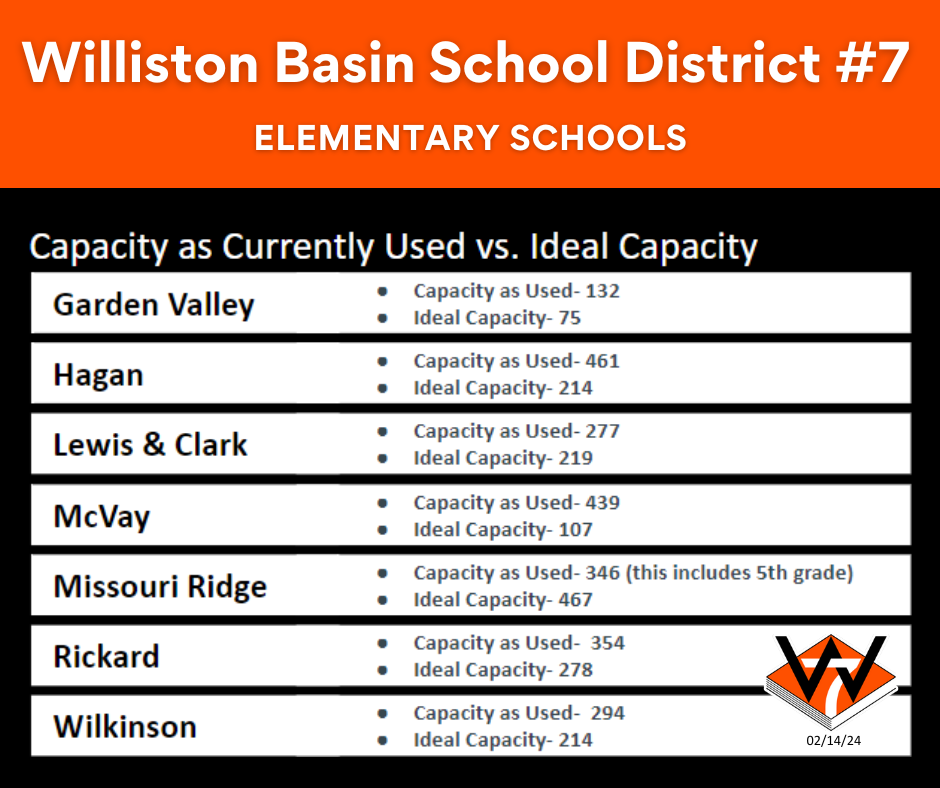

Williston Basin School District # 7’s primary challenge is our growing enrollment. RSP’s demographic study for the WBSD #7 community projects an enrollment increase by approximately 1000 students within the next 5 years. The current capacity allows for approximately 2,200 elementary students, including modular units.

Williston Basin School District #7 needs elementary classroom space to create a K-5 school structure at all elementary schools.

Fifth-grade students, except those at Missouri Ridge Elementary School, are housed at Williston Middle School Central Campus.

The District strategic plan is for elementary schools to have a K-5 grade configuration.

A middle school setting is not supported by educational research for 5th grade students.

An elementary school setting will allow for a self-contained classroom setting for 5th grade students.

Based on demographic data for projected growth, WBSD#7 will need future additional classroom space for elementary students and to decrease usage of portable classrooms as per the strategic plan. Demographic and Enrollment Report RSP Past Current and Future Enrollments

The percentage of elementary students that are being educated in modular or portable classrooms is approximately 63%.

There are 4,575 brick-and-mortar and 1,600 modular student capacity in the district. The average size of a modular classroom is about 550 sq feet. Typically, new classrooms are built between 900-1,200 sq feet to best serve the educational programming and student needs.

The modular classrooms are not functional for students, as the current modules are either small, run-down, outdated, or nearing or past their expected lifespan.

PROPOSED SOLUTION

Build one new 600+ student elementary school to:

Expand elementary school capacity to accommodate projected increases in enrollment.

Reintegrate all fifth-grade students into their respective elementary school environments.

Meet strategic plan objectives for students to have the same quality of K-5 school experience, regardless of their elementary school.

Increase future-ready classroom space.

Continue to analyze enrollment or demographic data to determine future space needs.

Set the district on a path to right-size enrollment at existing buildings and decrease reliance on modular or portable classroom space.

Locate the new building in growing areas of the community to reinforce neighborhood school strategy.

RESPONDING TO GROWTH

Page 7 of the "Long-Term Facilities Planning Report " states the following:

Responding to Growth

The district administration will modify the attendance areas to accommodate increased student enrollment when necessary.

After reviewing development plans and based on enrollment projections, a new school may be planned to open when 50% of the building capacity is reached.

Attendance areas will be changed accordingly. (The 50% criteria are a general guideline and may be adjusted to reflect the anticipated growth rate).

The Board needs to balance the capacity philosophies of neighborhood schools in new neighborhoods with the use of existing

facilities.

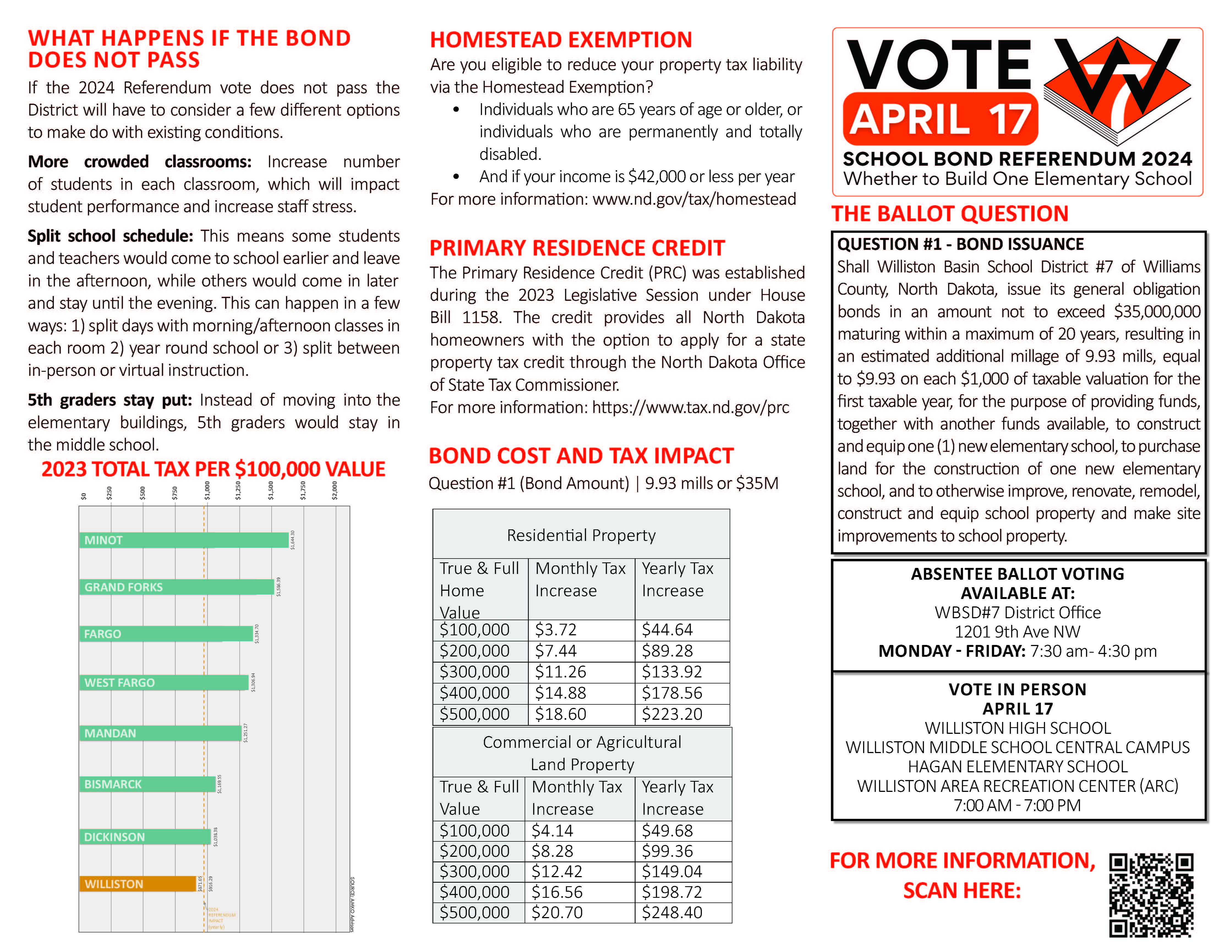

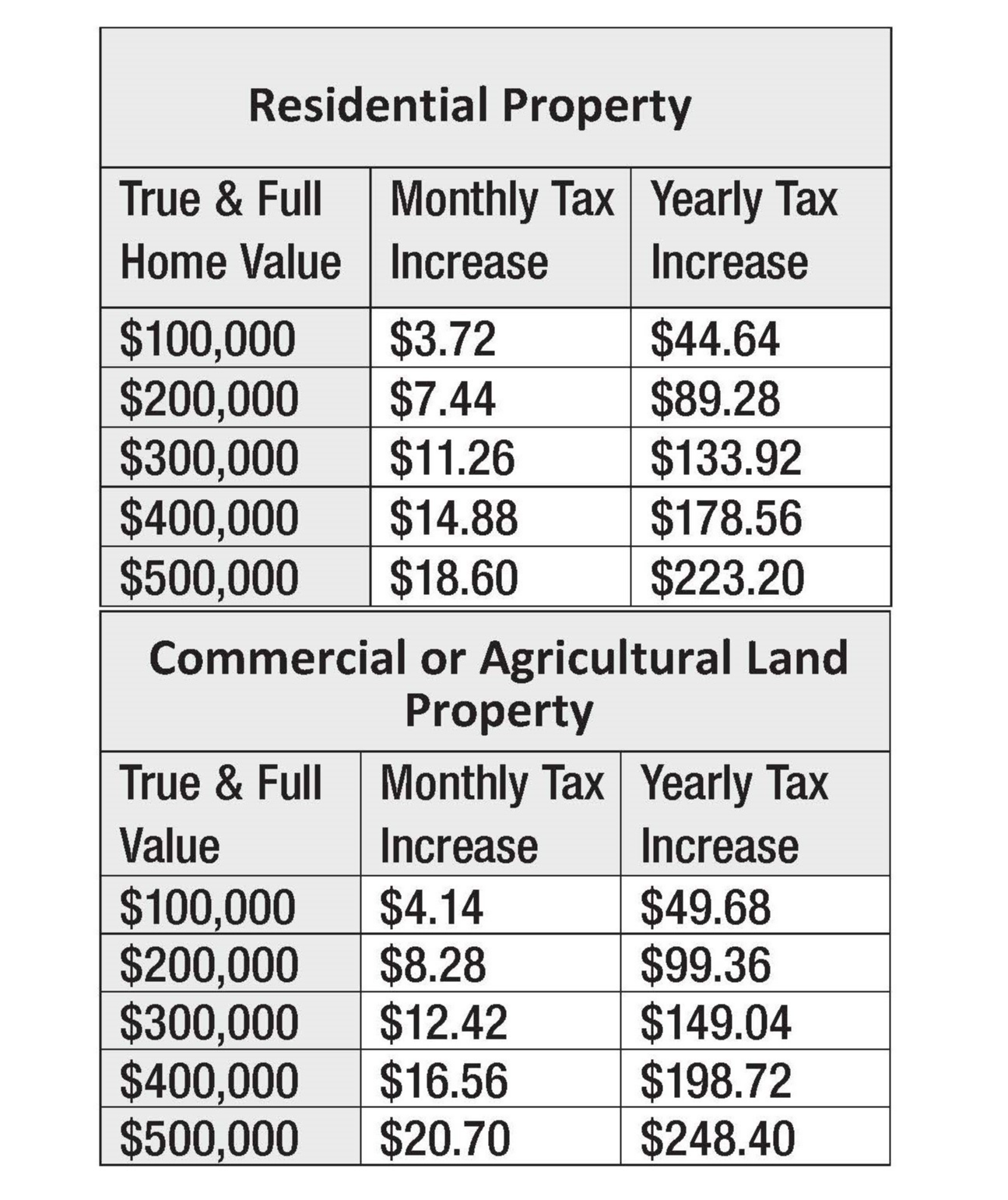

HOW WILL THIS IMPACT YOU?

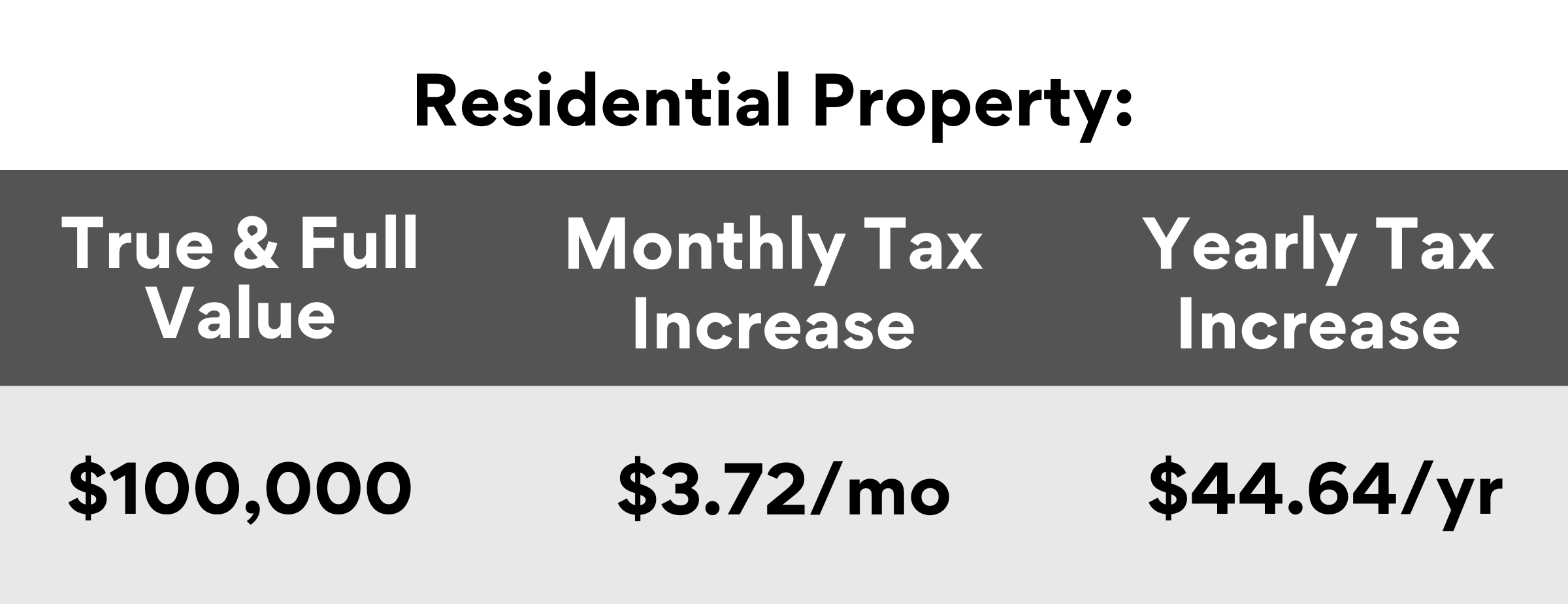

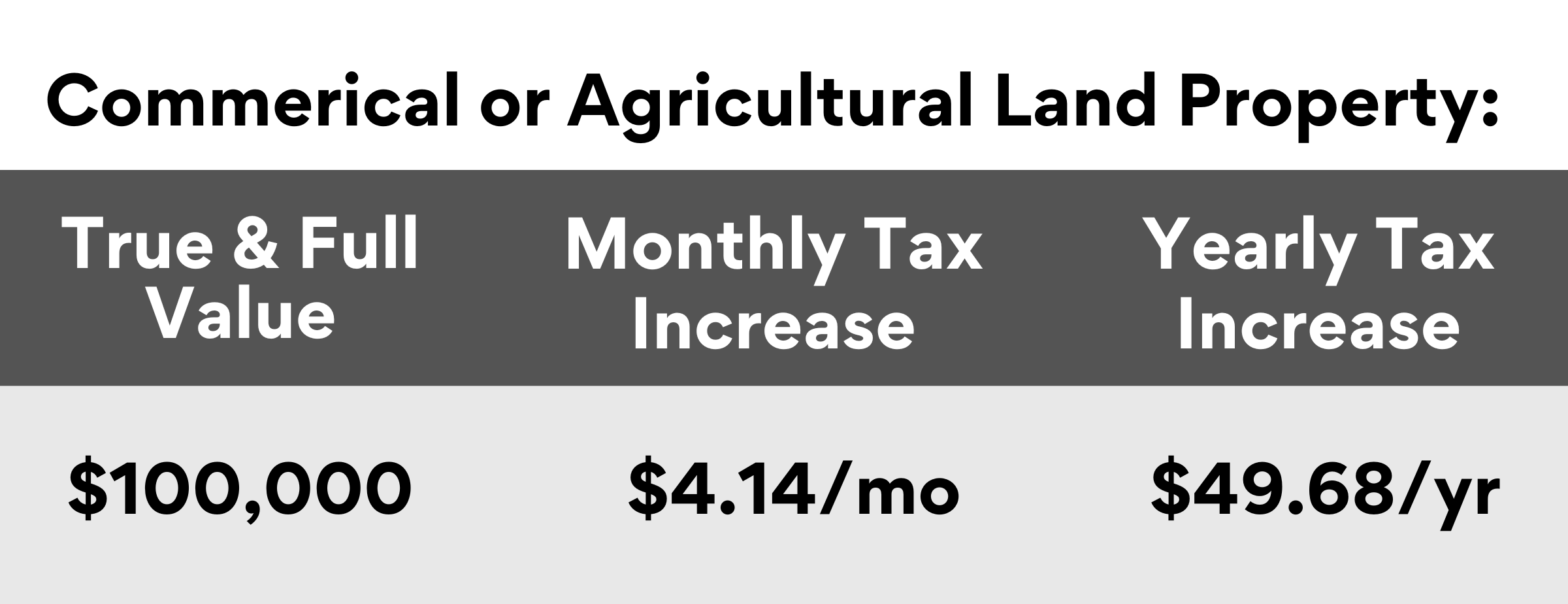

Estimated Tax Impact to Taxpayers

If the April 17, 2024 bond referendum to build one new elementary school passes, the district will levy the tax elementary school passes, the district will levy the tax increase beginning with the 2024-2025 school year. The tax increase would fist show on 2024 Estimated Tax Statements (mailed in August) as well as the final 2024 Tax Statement (mailed in December).

The 20-year bond would result in an increase of 9.93 mills, or $44.64 per year ($3.72 per month) for each $100,000 of True & Full Residential Property Value.

This referendum only impacts those living within Williston Basin School District #7. Please visit the Williston Basin School District #7 Boundary Map to see if your property is located within WBSD7.

To determine the estimated impact of the bond referendum, follow the instructions below.

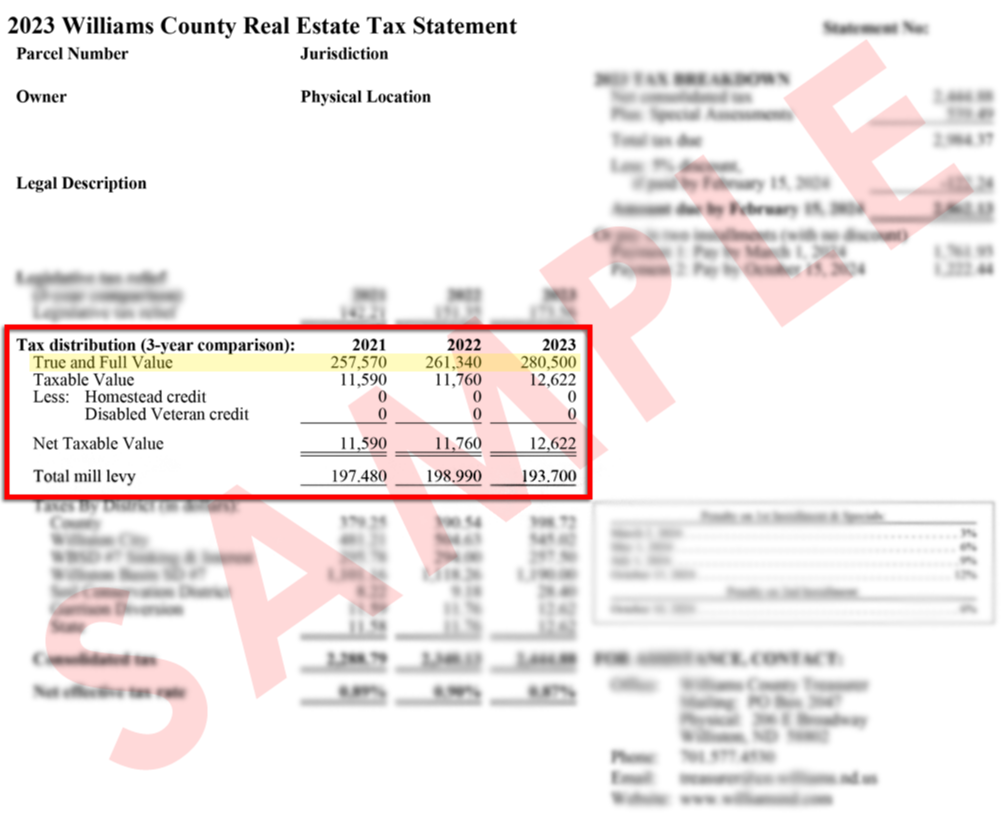

Find your property's True and Full Value on your 2023 Real Estate Tax Statement of by visiting the Williams County iTax system.

Please enter your estimated True and Full Value below. Note - You will need your True and Full Value for the Tax Impact Calculator. Please see the information below on how to find that information on your Property Tax Statement.

Please Note: The drop-down option for commercial and agricultural property tax calculations is currently under development. Until it is ready, please click this link to download the Excel spreadsheet calculator for determining commercial or agricultural estimated tax impact.

How do I find my property's True and Full Value?

The True and Full Value of your property can be found on your Property Tax Statement.

Tax Statement Example:

If you do not have your Property Tax Statement, the True & Full Value of the property can be found online in the Williams County iTax system.

In the “Value” Box – click Detail – then look at “Previous Market Value” to obtain True and Full.

Market value = the same as True and Full

Homestead Property Tax Credit Calculator

The Homestead Property Tax Credit and Renter’s Refund are property tax credits available to eligible North Dakotans. Individuals may qualify for a property tax credit or partial refund of the rent they pay, if one of the following requirements is met:

65 years of age or older, OR

An individual with a permanent and total disability

Proof of total disability must be established by a certificate from a licensed physician or a written determination of disability from the Social Security Administration or federal or state agency authorized to certify an individual’s disability.

There is no age requirement for those with a permanent and total disability.

A homeowner or renter with disability must meet the same requirements, except for age, as a senior citizen homeowner or renter.

For a married couple who are living together, only one may apply for the Homestead Property Tax Credit or Renter’s Refund. Only the spouse applying for the credit needs to be 65 years of age or older, or permanently and totally disabled.

The Homestead Property Tax Credit reduces the homeowner's taxable value according to the following:

If your income is | Your taxable value is reduced by | Maximum reduction of taxable value | Maximum reduction of true & full value |

$0 - $40,000 | 100% | $9,000 | $200,000 |

$40,001 - $70,000 | 50 % | $4,500 | $100,000 |

Calculate Your Homestead Property Tax Credit Impact

For more information regarding the Homestead Property Tax Credit and Renter's Refund visit the following link to the ND Tax website.